2026 PacificSource Dual Care (HMO D-SNP) Plan

This plan's premium is $0*

This is a special kind of Medicare Advantage HMO plan called a Dual Eligible Special Needs plan (or HMO D-SNP). It provides extra benefits for no additional cost to people who qualify for both Medicare and Medicaid. It combines your Original Medicare benefits, your Part D prescription drug coverage, and your Medicaid benefits.

PacificSource Dual Care is an HMO plan, which means you're covered at any of more than 30,000+ providers in our network. You're also covered for urgent and emergency care worldwide, regardless of provider, at the in-network level. The plan doesn't include coverage for providers outside the network, except in an emergency.

You can find in-network doctors and facilities in our Provider Directory, including many of the best-known names in the region.

This plan also includes prescription drug coverage (Medicare Part D). You can learn about costs for covered medications with our Drug Search tool, and find nearby pharmacies with our Pharmacy Search.

Am I eligible to enroll?

PacificSource Dual Care (HMO D-SNP) is available to you, if:

- You qualify for Medicare Parts A and B

- You're eligible or enrolled in full Medicaid benefits (Oregon Health Plan)

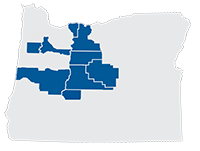

- You live in our service area: Crook, Deschutes, Hood River, Jefferson, Lane, Marion, Polk, or Wasco Counties, or northern Klamath County (zip codes 97731, 97733, 97737, or 97739)

**This plan has special enrollment requirements. To be eligible, you must qualify for full Medicaid benefits and Medicare. Cost shares, benefits, premiums, and deductibles listed reflect Medicare and Medicaid coverage. Your costs may vary if your Medicaid eligibility category and/or the level of Extra Help you receive changes.

Medicare Prescription Payment Plan

This optional program may benefit some members with high drug costs early in the plan year by spreading payments throughout the year. Contact us and we can help you determine whether you'd benefit. More details can also be found at our Medicare Prescription Payment Plan page.

Included Dental Benefits

This plan includes dental services, such as checkups, cleanings and x-rays, all with zero copay. To learn what’s covered, see the Summary of Benefits, updated 9/28/2025, at the top of the page.

Over-the-Counter Spending Allowance

Here's savings and convenience in one: this plan includes a quarterly credit good for popular health and wellness items from NationsOTC. Their catalog includes vitamins, supplements, and hundreds of popular products—all with free 2-day shipping.

The amount you can spend each quarter is $130.

To learn more, see the Over-the-Counter (OTC) product catalog or visit PacificSource.NationsBenefits.com.

No-cost Fitness Benefit

One Pass™ delivers flexible fitness for all, whether you work out at home or at the gym, and includes:

One Pass™ delivers flexible fitness for all, whether you work out at home or at the gym, and includes:

- Access to a large nationwide network of gyms and fitness locations

- Freedom to choose: Visit multiple facilities in the same month

- Live digital fitness classes and on-demand workouts

- Online brain training made just for you to help improve your memory and focus

To learn more, visit YourOnePass.com or call them at 877-504-6830.

Hearing Benefits

The Dual Care plan includes several benefits for your hearing health. You are eligible for:

- $0 Hearing exams. Some limitations apply

- $0 Hearing aids: One hearing aid for each ear every 5 years

- 60 hearing aid batteries per year

Prior authorization required for hearing aids and batteries.

Additional Benefits and Plan Features

The following benefits and services are available to PacificSource Medicare members at no additional cost:

- Care Programs

If you have a chronic health condition such as Diabetes, COPD, Congestive Heart Failure, or Asthma, you get personal attention to improve your health, overcome barriers, and coordinate your care. - Quality Improvement Programs

Our in-network providers partner with us to improve your care and services. We use objective and subjective benchmarks to measure and evaluate quality and safety to ensure you’re getting the right care. - Health Screenings, Events, and Immunization Programs

You get free health screenings, educational events, immunization programs, and health risk assessments to help you manage chronic conditions and live the life you want. - Personal Medication Review

Get free one-on-one consultations with a pharmacist to identify any safety issues, interactions, cost-savings, and other changes to improve your health. Your pharmacist will work with your doctor to help you get the most out of your coverage.

Services Not Covered or Limited

The following are some of the items and services that aren’t covered under Original Medicare or by our plans. This is a partial list and does not include all limitations and exclusions. For a detailed list, please see your Evidence of Coverage.

- Care received in any non-Medicare approved hospital or skilled nursing facility

- Cosmetic surgery or procedures

- Custodial care

- EBT (Electron-Beam Tomography) Scans

- Elective or voluntary enhancement procedures, services, supplies, and medications

- Experimental or investigational medical and surgical procedures, equipment, and medications

- Immunizations for the sole purpose of travel

- Incontinence supplies

- Long-term services

- Orthognathic Surgery for TMJ

- Orthopedic shoes (some exceptions apply)

- Private room in a hospital, unless medically necessary

- Radial keratotomy, LASIK surgery, vision therapy, and other low vision aids and services

- Routine dental care such as cleanings (unless your plan includes dental or you have purchased optional dental coverage), fillings, or dentures

- Routine lab work, X-rays, or EKG’s done without medical indication except as outlined in the Preventive Services section of the Summary of Benefits

- Items and services that are specifically excluded by Medicare, with exception of services listed in the benefit chart. To find out more, go to www.Medicare.gov/coverage .

Enrollment Resources

To find a plan that's right for you, we recommend you look at two or more plans, comparing their benefits, copays, coinsurance, monthly premiums, and prescription drug coverage. The links and documents below will help you decide on a plan.

Below you'll also find the D-SNP eligibility requirements, enrollment dates, and ways to enroll.

Am I eligible for PacificSource Dual Care?

PacificSource Dual Care (HMO D-SNP) is available to you, if:

- You qualify for Medicare Parts A and B

- You're eligible or enrolled in full Medicaid benefits (Oregon Health Plan)

- You live in one of these areas of Oregon: Crook, Deschutes, Hood River, Jefferson, Lane, Marion, Polk, or Wasco Counties, or northern Klamath County (zip codes 97731, 97733, 97737, or 97739)

When can I enroll?

When you can enroll in PacificSource Dual Care (HMO D-SNP) depends on your situation.

If you have just become eligible for Medicare and full Medicaid benefits:

- You can enroll in a D-SNP at any time, year-round

If you already have both Medicare and Medicaid, or are already enrolled in a D-SNP, you can enroll in or switch D-SNP plans:

-

Once per special enrollment period (SEP):

- January 1 – March 31

- April 1 – June 30

- July 1 – September 30

-

Or any time during the Annual Enrollment Period (AEP):

- October 15 – December 7

When will my coverage begin?

When your coverage begins depends on your situation, and when you submit your application. If you’re already on Medicare, it could be as soon as the first day of the month after we receive your application. Contact us with questions.

Ready to enroll?

We offer a variety of ways to enroll:

Online

Use our online enrollment center.

By phone

Call us at 855-265-5969. Our knowledgeable, local staff will guide you through the process.

With a broker

PacificSource Medicare partners with select local insurance producers (brokers) who can help. Contact us for help finding a broker.

Contact a community partner

Trained community partners across the state can help you fill out an application. It's free.

Visit OregonHealthCare.gov to find community partners in your area.

What happens after I enroll?

After you enroll in a PacificSource Medicare plan, we will send your completed enrollment form to the Centers for Medicare & Medicaid Services (CMS) for approval. Once we receive confirmation from CMS, we will send you a confirmation letter.

You will also receive your new member packet and ID card within 10 business days after we receive confirmation from CMS. Your coverage will begin on your effective date. If you have any questions, please call or email us.

Members may enroll in the plan only during specific times of the year. You must have Part A and Part B to enroll in the plan. Contact us for more information.

What Is Medicare?

Medicare is a health insurance program for:

- People 65 or older

- People under 65 with certain disabilities

- People of all ages with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a kidney transplant)

The Parts of Medicare: A, B, C & D

Original Medicare Includes Part A and Part B:

Part A - Hospital Insurance:

Part A helps cover inpatient care in hospitals, skilled nursing facilities (not custodial or long-term care), hospice and some home health care. Many people automatically get Part A once they start receiving disability benefits from Social Security. Most people don't pay a premium for Part A because they or a spouse already paid for it through their payroll taxes while working.

Part B - Medical Insurance:

Part B helps cover doctors' services, outpatient hospital care, preventive care, physical and occupational therapists, and some home health care. Most people pay a monthly premium for Part B. You will need to sign up for Part B during your initial enrollment period (the 7-month period that begins 3 months before the month you turn 65; includes the month you turn 65; and ends 3 months after the month you turn 65). If you don’t sign up for Part B when you are first eligible, you may have to pay a late enrollment penalty.

Part C – Medicare Advantage Plans:

Part C is Medicare Advantage plans such as HMOs and PPOs. PacificSource offers Medicare Advantage Plans. Part C is administered by insurers such as PacificSource under contract with Medicare. These plans include both Medicare Part A and Part B in one convenient plan, and fill in some of the gaps in Medicare coverage. Some plans also include Part D Prescription drug coverage and preventive dental in a single plan. Most people will pay a monthly premium for Part C coverage. You must continue to pay your Part B premium and must have both Part A and Part B to enroll.

Part D - Prescription Drug Coverage:

Part D is prescription drug coverage run by private companies approved by and under contract with Medicare. These plans help lower prescription drug costs and help protect against higher costs in the future. Like other insurance, if a beneficiary decides not to enroll in a drug plan when they are first eligible, they may pay a penalty if they choose to join later. Most people will pay a monthly premium for this coverage.

You may be able to get Extra Help to pay for your prescription drug premiums and costs. To see if you qualify, call:

- 800-MEDICARE (800-633-4227). TTY users should call 877-486-2048, 24 hours a day/7 days a week;

- The Social Security Office at 800-772-1213 between 7:00 a.m. and 7:00 p.m., Monday through Friday. TTY users should call 800-325-0778; or

- Your State Medicaid Office.

What You Pay

Below are some of the costs you will pay if you have only original Medicare:

Part B (Medical)

- $185 monthly premium*

- $257 yearly Part B deductible (you must first pay this amount for covered services before Medicare begins paying for your coverage)

- 20% of the costs for most services, including doctor office visits, outpatient surgery, emergency and urgent care

Part A (Hospital)

- $1,676 deductible per benefit period

- $0 per day (days 0-60)

- $419 per day (days 61-90)

- $838 per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

- You pay all costs beyond lifetime reserve days

Part D (Prescription)

- Monthly premium: varies by plan and income

*Most people will pay the standard monthly Part B premium. However, some people will pay a higher premium because of their yearly income (over $106,000 for singles, $212,000 for married couples). For more information about Part B premiums based on income, call Medicare at 800-MEDICARE (800-633-4227). TTY users should call 877-486-2048. You may also call Social Security at 800-772-1213. TTY users should call 800-325-0778.

What Medicare Doesn't Cover

There are some limitations to Original Medicare. In most cases, the following are not covered:

- Care received outside the United States

- Outpatient prescription drugs

Also, note that not all doctors accept Original Medicare, and there is no annual limit on your total out-of-pocket expenses.

Medicare Advantage and Medicare Supplement

If you want extra coverage in additional to Original Medicare, you can purchase it either through a Medicare Advantage plan or with a Medicare Supplement plan. With both plans, you are still on Medicare. Here are the main differences:

Medicare Advantage Plan (such as PacificSource Medicare plans)

These plans fill in the gaps by covering some of the costs Medicare does not cover. We provide more benefits than Medicare alone, or Medigap plans. And we provide personal service to make it easy.

We offer a variety of plans, including low-priced plans to help save you money. You can also get the convenience of plans that include medical (Part A and Part B) and prescription drug coverage (Part D) all in one plan. Most of our Medicare Advantage plans include dental benefits. For those who qualify for both Medicare and Medicaid, we also offer a PacificSource Dual Care, an HMO D-SNP plan.

Finding a doctor is easy, because nearly every doctor in the region accepts PacificSource. And, with all our PPO and HMO-POS plans, you have the freedom to see any doctor who accepts Medicare in the United States. You're also covered when you travel, with worldwide urgent and emergency care.

When you go to the doctor you will need only one ID card: your PacificSource Medicare ID card. The front of the card will show whether you have medical, prescription drug, and/or dental coverage. The doctor's office will bill us. We will pay the bills on behalf of Medicare. Medicare reimburses us for their portion of the costs. Since we deal directly with Medicare, you and your doctor have less paperwork.

Monthly premiums are the same for all ages. Everyone on a particular plan will pay the same premium for that year.

For more information on Medicare Advantage plans, or to enroll, please call: 855-265-5969, TTY: 711

Medicare Supplement Plan (Medigap)

These plans also fill in gaps in Medicare coverage. Original Medicare will cover the services under Part A and Part B. The Medigap plan will then cover some of the additional costs Medicare did not cover. If you also want prescription coverage, you would need to purchase a Part D plan in addition to your Medigap plan.

Not all doctors accept Original Medicare. If your doctor does not accept Original Medicare, you will either need to find another doctor, pay for the services yourself, or enroll in a plan that has a contract with your doctor. Generally, services outside the United States are not covered.

When you see a doctor, you must bring two ID cards: your red, white, and blue Medicare card and your Medigap card. The doctor will send bills to two places: first to Medicare to pay their portion, then to your Medigap plan to pay the plan's portion.

With Medigap, monthly premiums are based on your age.

Want to Learn More About Medicare?

Call 800-MEDICARE (800-633-4227) or visit www.medicare.gov for more information about Medicare benefits and services, including general information regarding medical or Part D benefits. TTY users should call 877-486-2048, 24 hours a day/7 days a week.