2026 PacificSource Dual Care (HMO D-SNP) Plan

Your plan premium is $0*

This is a special kind of Medicare Advantage HMO plan called a Dual Eligible Special Needs plan (or HMO D-SNP). It provides extra benefits for no additional cost to people who qualify for both Medicare and Medicaid. It combines your Original Medicare benefits, your Part D prescription drug coverage, and your Medicaid benefits.

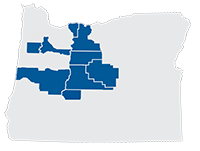

PacificSource Dual Care is an HMO plan, which means you're covered at any of more than 30,000+ providers in our network. You're also covered for urgent and emergency care worldwide, regardless of provider, at the in-network level. The plan doesn't include coverage for providers outside the network, except in an emergency.

You can find in-network doctors and facilities in our Provider Directory, including many of the best-known names in the region.

This plan also includes prescription drug coverage (Medicare Part D). You can learn about costs for covered medications with our Drug Search tool, and find nearby pharmacies with our Pharmacy Search.

*Cost shares, benefits, premiums, and deductibles listed reflect Medicare and Medicaid coverage. Your costs may vary if your Medicaid eligibility category and/or the level of Extra Help you receive changes.

Included Dental Benefits

This plan includes dental services, such as checkups, cleanings and x-rays, all with zero copay. To learn what’s covered, see the Summary of Benefits, updated 9/28/2025, at the top of the page.

2026 PacificSource Dual Care (HMO D-SNP) Evidence of Coverage by Chapter

-

Chapter 1. Getting started as a member

Tells about materials we will send you, your plan premium, your plan membership card, and keeping your membership record up to date.

-

Chapter 2. Important phone numbers and resources

Tells you how to get in touch with PacificSource Medicare, Medicare, the Quality Improvement Organization, Social Security, Medicaid, and the Railroad Retirement Board.

-

Chapter 3. Using the plan's coverage for your medical services

Explains how to get medical care, use providers in our network, get care when you have an emergency, get out-of-network services, and rules about referrals, lock-in, and cost-sharing.

-

Chapter 4. Medical Benefits Chart (what is covered and what you pay)

Explains what medical care is covered, how much you pay, and how much the plan pays. Explains what's covered under optional preventive dental.

-

Chapter 5. Using the plan's coverage for your Part D prescription drugs

Tells how to use the List of Covered Drugs (Formulary) to find out which drugs are covered, what's not covered, as well as rules and restrictions that may apply. Explains where to get your prescriptions filled, drug safety, and programs for managing medications.

-

Chapter 6. What you pay for your Part D prescription drugs

Tells about the stages of drug coverage (Initial, Coverage Gap, Catastrophic), cost-sharing tiers, what you pay for drugs in each tier, and the late enrollment penalty.

-

Chapter 7. Asking us to pay our share of a bill you have received for covered medical services or drugs

Explains when and how to send a bill to us when you want to ask us to pay you back for our share of the cost for your covered services.

-

Chapter 8. Your rights and responsibilities

Explains the rights and responsibilities you have as a member of our plan, and what you can do if you think your rights are not being respected.

-

Chapter 9. What to do if you have a problem or complaint (coverage decisions, appeals, complaints)

Information and step-by-step instructions on what to do if you are having problems or concerns. Explains how to file a grievance, ask for coverage decisions, make complaints, and an appeal.

-

Chapter 10. Ending your membership in the plan

Explains when and how you can end your membership, situations where our plan is required to end your membership, and your rights and responsibilities upon disenrollment.

-

Chapter 11. Legal notices

Includes notices about governing law and about nondiscrimination.

-

Chapter 12. Definitions of important words

Explains key terms used in this booklet.

Over-the-Counter Spending Allowance

Here's savings and convenience in one: this plan includes a quarterly credit good for popular health and wellness items from NationsOTC. Their catalog includes vitamins, supplements, and hundreds of popular products—all with free 2-day shipping.

The amount you can spend each quarter is $130.

To learn more, see the Over-the-Counter (OTC) product catalog or visit PacificSource.NationsBenefits.com.

No-cost Fitness Benefit

One Pass™ delivers flexible fitness for all, whether you work out at home or at the gym, and includes:

One Pass™ delivers flexible fitness for all, whether you work out at home or at the gym, and includes:

- Access to a large nationwide network of gyms and fitness locations

- Freedom to choose: Visit multiple facilities in the same month

- Live digital fitness classes and on-demand workouts

- Online brain training made just for you to help improve your memory and focus

To learn more, visit YourOnePass.com or call them at 877-504-6830.

Hearing Benefits

The Dual Care plan includes several benefits for your hearing health. You are eligible for:

- $0 Hearing exams. Some limitations apply

- $0 Hearing aids: One hearing aid for each ear every 5 years

- 60 hearing aid batteries per year

Prior authorization required for hearing aids and batteries.

Member Resource Center

Learn how to use your benefits by viewing or downloading these helpful resources including your plan specific Guide as well as information about other benefits like hearing, One Pass Fitness, OTC and more!

Log in to InTouch for more details about your specific plan benefits, view your EOBs, sign-up for email communications, and much more! You can also use this link to print and ID card.

Please click the link below for your plan type to be taken to the Member Resource Center:

Rewards for Healthy Actions

Just complete the activity below and you can select a gift card from one of more than 100 popular stores and restaurants. For a full list of participating retailers, see the InCentives flier. There's no need to register; award certificates will come in the mail once your claims are processed. To learn more, see the Rewards program flier.

| Annual Wellness Visit | $50 |

| Health Risk Assessment | $15 |

Clinical Policies and Practice Guidelines

PacificSource Medicare uses guidelines and policies to help doctors and members make decisions about their health care. These are not meant to replace the decisions of treating providers. Updates are made on a yearly basis as needed.

Clinical Policies and Practice GuidelinesWhat to do if you have a problem or concern

Start HereIs your problem about your benefits or coverage? |

|

|---|---|

|

YES See the information below about Coverage Decisions and Payment Requests or Appeals |

NO See the information below about Complaints |

There are three types of problems or concerns:

- Appeal: is a formal way of asking us to review and change a coverage decision we have made.

- Coverage decision: is a decision we make about your benefits and coverage, or about the amount we will pay for your medical services, or if you request reimbursement or to pay a bill you have received from a provider for covered medical services or drugs. "Organization determination" or "coverage determination" are legal terms for a coverage decision.

- Complaint (Grievance): is when you tell us about a problem or concern about us or one of our in-network providers, including the quality of your care. This type of complaint does not involve a coverage decision or a payment dispute. If your problem is about the plan’s coverage or payment, you should look at the section above about making an appeal. A "grievance" is the legal term for a complaint.

Coverage Decisions and Payment Requests

A coverage decision is a decision we make about your benefits and coverage or about the amount we will pay for your medical services or drugs. If you ask us for reimbursement or to pay a bill you have received from a provider for covered medical services or drugs, we are making a coverage decision for you whenever we decide what is covered for you and how much we pay. In some cases we might decide a service or drug is not covered or is no longer covered by Medicare for you. If you disagree with this coverage decision, you can make an appeal. Please see the section below about appeals.

-

For Medical Care

If you are in any of the five following situations, you can ask us for a coverage decision if:

- You are not getting certain medical care you want, and you believe that this care is covered by our plan.

- Our plan will not approve the medical care your doctor or other medical provider wants to give you, and you believe that this care is covered by the plan.

- You have received medical care or services that you believe should be covered by the plan which was included in the Evidence of Coverage, but we have said we will not pay for this care.

- You have received and paid for medical care or services that you believe should be covered by the plan, and you want to ask our plan to reimburse you for this care.

- You are being told that coverage for certain medical care you have been getting that we previously approved will be reduced or stopped, and you believe that reducing or stopping this care could harm your health.

Start by calling, writing, or faxing us your request for us to provide coverage for the medical care you want or to reimburse you for medical care you paid for. You, your doctor, or your representative can do this. Click here to contact us.

We will give you an answer within 14 calendar days after we receive your request unless you ask for more time or if we need more information that may benefit you. If your health requires it, you can ask for a fast coverage decision which means we will answers within 72 hours. If your doctor tells us that your health requires it, we will automatically give you a fast coverage decision. Otherwise, you must meet two requirements:

- You can get a fast coverage decision only if you are asking for coverage for medical care you have not yet received. (You cannot get a fast coverage decision if your request is about payment for medical care you have already received.)

- You can get a fast coverage decision only if using the standard deadlines could cause serious harm to your health or hurt your ability to function.

-

For Part D Prescription Drugs

If a drug is not covered in the way you would like it to be covered, you can ask us to make an "exception." An exception is a type of coverage decision where you ask:

- us to cover a drug that is not on the List of Covered Drugs (Formulary).

- us to remove a restriction on a drug (such as a limit on the amount of the drug you can get).

- to pay a lower cost-sharing amount for a covered Part D prescription drug.

- us whether a drug is covered for you and whether you satisfy any applicable coverage rules (such as when your drug is on the formulary but we require you to get approval from us before we will cover it for you).

Start by calling, writing, or faxing us your request for us to provide coverage for the Part D prescription drug you want. You, your doctor, or your representative can do this. Click here to contact us.

We will give you an answer within 72 hours after we receive your request for a drug you have not yet received or within 14 days for a drug you have already received unless you ask for more time or if we need more information that may benefit you. If your health requires it, you can ask for a fast coverage decision (also called an expedited coverage determination) which means we will answers within 24 hours. If your doctor tells us that your health requires it, we will automatically give you a fast coverage decision. Otherwise, you must meet two requirements:

- You can get a fast coverage decision only if you are asking for coverage for medical care you have not yet received. (You cannot get a fast coverage decision if your request is about payment for medical care you have already received.)

- You can get a fast coverage decision only if using the standard deadlines could cause serious harm to your health or hurt your ability to function.

If you are not satisfied with our coverage decision, you may ask for an appeal. Please see the section below about appeals.

Appeals

If we make a coverage decision and you are not satisfied with this decision, you can "appeal" the decision. An appeal is a formal way of asking us to review and change a coverage decision we have made. When you make an appeal, we review the coverage decision we have made to check to see if we were following all of the rules properly. Your appeal is handled by different reviewers than those who made the original decision. When we have completed the review we give you our decision.

In order to process your appeal, we must receive it within 60 calendar days of the denial date.

-

For Medical Care

Start by writing or faxing us your request for us to provide coverage for the medical service you want. You, your doctor, or your representative can do this. Click here to contact us.

We will give you an answer within 30 calendar days after we receive your request unless you ask for more time, or if we need more time to obtain information that may benefit you. If your health requires it, you can ask for a fast coverage decision to be provided within 72 hours of receipt of your request.

-

For Part D Prescription Drugs

Start by writing or faxing us your request for us to provide coverage for the Part D prescription drug you want. You, your doctor or prescriber, or your representative can do this. Click here to contact us.

We will give you an answer within 7 calendar days after we receive your request. If your health requires it, you can ask for a fast coverage decision to be provided within 72 hours of receipt of your request.

If we say no to all or part of your appeal, you can go on to a Level 2 Appeal process. The Level 2 Appeal is conducted by an independent organization that is not connected to us. (In some situations, your case will be automatically sent to the independent organization for a Level 2 Appeal. If this happens, we will let you know. In other situations, you will need to ask for a Level 2 Appeal.) If you are not satisfied with the decision at the Level 2 Appeal, you may be able to continue through several more levels of appeal.

Complaints (Grievances)

A complaint is when you have a problem or concern with the quality of care, waiting times, customer service or other concerns about service provided to you. This type of complaint does not involve a coverage decision or a payment dispute. If your problem is about the plan’s coverage or payment, you should look at the section above about making an appeal. A complaint is when you tell us about a problem or concern with:

- the quality of your medical care.

- respect of your privacy.

- disrespect, poor customer service or other negative behaviors.

- waiting times.

- cleanliness.

- information you get from us.

- timeliness of coverage decisions and appeals.

Start by calling or writing Customer Service with your complaint. Click here to contact us. In order to review your complaint, we must receive it within 60 calendar days after you had the problem or concern you want us to address.

Most complaints are answered within 30 calendar days. If we need more information and the delay is in your best interest or if you ask for more time, we can take up to 14 more calendar days (44 calendar days total) to answer your complaint. If you are making a complaint because we denied your request for a "fast coverage decision" or a "fast appeal," we will automatically give you a "fast" response. If you have a "fast" complaint, it means we will give you an answer within 24 hours.

Once we have reviewed your complaint, we will respond and address your concerns in writing.

For concerns about the quality of your medical care, you can make the complaint to us, and/or, you can make your complaint to a Quality Improvement Organization. The Quality Improvement Organization is a group of practicing doctors and other health care experts paid by the Federal government to check and improve the care given to Medicare patients. To find the name, address, and phone number of the Quality Improvement Organization for your state, look in Chapter 2 of your Evidence of Coverage. If you make a complaint to this organization, we will work with them to resolve your complaint.

For complaints about our plan, you can also submit directly to Medicare. To submit a complaint to Medicare, go to www.Medicare.gov/MedicareComplaintForm/home.aspx .

Submitting Appeals or Complaints Online

You can submit an appeal or complaint through our secure website for members, InTouch. Click "InTouch Login" at the top of our plan website to register or login into your account. There are two ways you can access our online appeal and complaint forms:

- From the Tools menu, choose "File Appeal or Grievance."

- From the Quick Links box, choose "File Appeal or Grievance."

An online form will appear for you to fill out. The form has two sections, one is for appeals (Tab 1) and the other is for complaints (grievances) (Tab 2). Fill out the section that applies to your situation. After you have completed the form(s) click “Submit” to submit your request to the plan for review. Follow up notices will be sent to you by mail (or phone call for expedited reviews).

Asking For Someone to Request a Coverage Decision, Appeal, or Complaint on Your Behalf

If you have someone filing a complaint on your behalf, or someone appealing our decision for you other than your doctor or prescriber (for Part D prescription appeals), unless you have a Power of Attorney for Healthcare on file, your complaint/appeal must include an Appointment of Representative form authorizing this person to represent you, or a copy of the Power of Attorney for Healthcare. Click here to complete the "Appointment of Representative" form. While we can accept a complaint or appeal request without the form, we cannot review the issue until we receive it. If we do not receive the form within 44 days after receiving your complaint or appeal request (our deadline for making a decision), your appeal request will be sent to the Independent Review Organization for dismissal. Complaints will be dismissed directly by the plan without further review.

How to Obtain an Overall Number of Complaints, Appeals, and Exceptions

You can call Customer Service for information on how to get an overall number of complaints, appeals, and exceptions filed with us.

Additional Resources

We are always available to help you. But in some situations you may also want help or guidance from someone who is not connected with us. You can always contact your State Health Insurance Assistance Program (SHIP). You can also contact Medicare. Here are two ways to get information directly from Medicare:

- Call 1-800-MEDICARE or 800-633-4227, 24 hours a day, 7 days a week. TTY users should call 877-486-2048.

- Visit Medicare’s website at www.Medicare.gov .

You also have the right to hire a lawyer to act for you. You may contact your own lawyer, or get the name of a lawyer from your local bar association or other referral service. There are also groups that will give you free legal services if you qualify. However, you are not required to hire a lawyer to ask for any kind of coverage decision or appeal a decision.

Part D Prescription Drug Information

Your plan includes Part D prescription drug coverage. The List of Covered Drugs (also called a formulary) includes a list of drugs selected by the plan with the help of a team of doctors and pharmacists. The drugs on this list are covered under Medicare Part D. The drug list includes both brand name and generic drugs. A generic drug is a prescription drug that has the same active ingredients as the brand name drug. Generally, it works just as well as the brand name drug and usually costs less. There are generic drug substitutes available for many brand name drugs. Your plan also covers certain over-the-counter drugs. Some over-the-counter drugs are less expensive than prescription drugs and work just as well.

Your plan does not cover all prescription drugs. In some cases, the law does not allow any Medicare plan to cover certain types of drugs, and in other cases, your plan decided not to include a particular drug on the drug list. Every drug on the drug list is in one of cost-sharing tiers below:

- Tier 1 includes Preferred Generic drugs.

- Tier 2 includes Generic drugs.

- Tier 3 includes Preferred Brand drugs.

- Tier 4 includes Nonpreferred Brand drugs.

- Tier 5 is the highest cost-sharing tier and includes Specialty drugs.

Part D Out-of-pocket Maximum: After your out-of-pocket costs reach $2,100, you pay $0 until the end of the calendar year.

-

When a generic is available, our network pharmacies will provide you the generic version.

We usually will not cover the brand name drug when a generic version is available. However, if your provider has told us the medical reason that the generic drug will not work for you, OR has written "No substitutions" on your prescription for a brand name drug, OR has told us the medical reason that neither the generic drug nor other covered drugs that treat the same condition will work for you, then we will cover the brand name drug. Your share of the cost may be greater for the brand name drug than for the generic drug. - Getting plan approval in advance.

For certain drugs, you or your provider need to get approval from the plan before we will agree to cover the drug for you. This is called "prior authorization." Sometimes the requirement for getting approval in advance helps guide appropriate use of certain drugs. If you do not get this approval, your drug might not be covered by the plan. - Trying a different drug first.

This requirement encourages you to try less costly but just as effective drugs before the plan covers another drug. For example, if Drug A and Drug B treat the same medical condition, the plan may require you to try Drug A first. If Drug A does not work for you, the plan will then cover Drug B. This requirement to try a different drug first is called "step therapy." - Quantity limits.

For certain drugs, we limit the amount of the drug that you can have. For example, the plan might limit how many refills you can get, or how much of a drug you can get each time you fill your prescription. For example, if it is normally considered safe to take only one pill per day for a certain drug, we may limit coverage for your prescription to no more than one pill per day.

For more information about Part D prescription drugs, you can contact us. We have a team of pharmacy experts that can help you avoid adverse events, ensure your drugs don’t interact with each other, and find alternative medications that may work for your conditions. And we can help provide you with one-on-one consultations with a clinical pharmacist. Call Customer Service for more information.

Low Income Subsidy (LIS) Premium Information

Your plan premium includes coverage for both medical services and prescription drug coverage. If you have limited resources and income, you may be able to get Extra Help paying for your drug costs. The amount of financial help awarded is based on income and resources. You may get help with your monthly premiums or drug copayments. In addition, there is no gap in coverage (no donut hole). According to the Social Security Administration, Extra Help is estimated to be worth about $4,000 per year. Some people are automatically eligible. You will qualify for Extra Help if you have Medicare and any of these conditions:

- You have full Medicaid coverage.

- You get help from your state Medicaid program paying your Part B premiums (in a Medicare Savings Program).

- You get Supplemental Security Income (SSI) benefits.

You may be eligible for Extra Help if you meet the following conditions:

- You live in one of the 50 States or the District of Columbia.

- Your resources are limited to $14,100 for an individual or $28,150 for a married couple living together. Resources include things such as bank accounts, stocks, and bonds. Your home, car, and things like life insurance are not considered to be resources.

- Your annual income is limited to $18,210 for an individual or $24,690 for a married couple living together. If your annual income is more than this, you still may be eligible for help if:

- You support other family members who live with you and have earnings from working.

If you get Extra Help from Medicare to help pay for your Medicare prescription drug plan costs, your monthly plan premium will be lower than what it would be if you did not get Extra Help from Medicare. The amount of Extra Help you get will determine your total monthly plan premium as a member of our plan. The links below provide you with the premium you would pay as a member of our plan while you are getting Extra Help, and Best Available Evidence which will assist you in determining what level of assistance you may qualify for if Medicare’s system does not reflect the most up-to-date and accurate subsidy information.

LIS Premium Information, updated 9/28/2025)

If you aren’t getting extra help, you can see if you qualify by contacting us or by:

- Calling 800-Medicare. TTY/TDD users should call 877-486-2048 (24 hours a day/7 days a week)

- Contacting your State Medicaid Office

- Calling the Social Security Administration at 800-772-1213 or applying online at www.SSA.gov/PrescriptionHelp . TTY/TDD users should call 800-325-0778 between 7:00 a.m. and 7:00 p.m., Monday through Friday.